Tax brackets are an essential part of the progressive tax system used by many countries, including the United States. They refer to the income ranges that determine the rate at which an individual's or household's income is taxed. Essentially, the more you earn, the higher percentage of your income is taxed, though the system is designed so that only the portion of income within each bracket is taxed at the corresponding rate.

How Tax Brackets Work

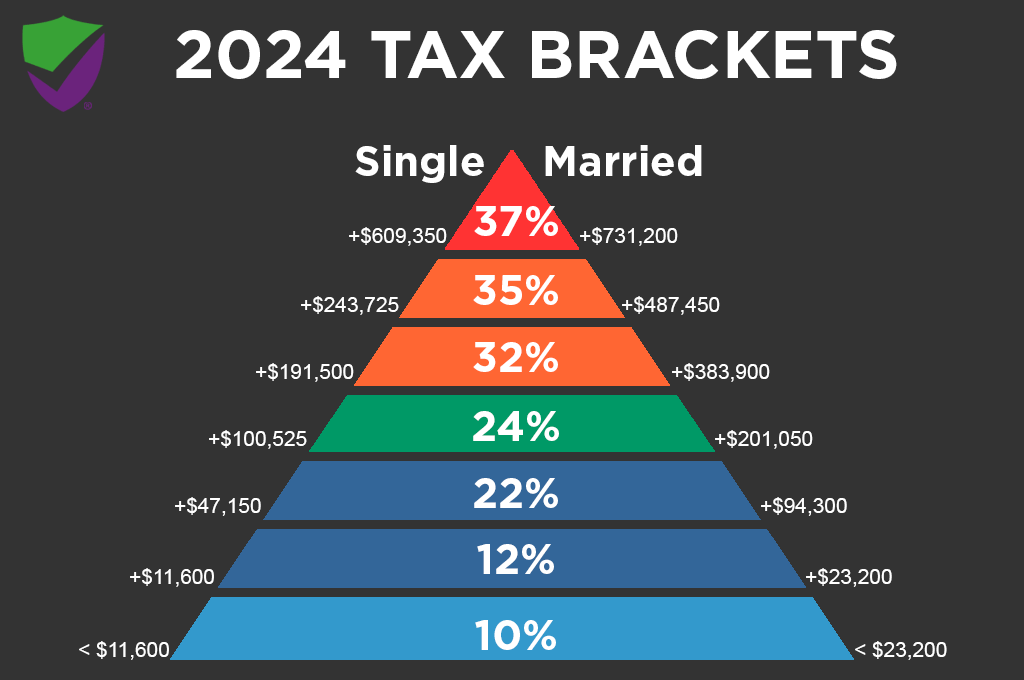

Tax brackets divide income into sections, each taxed at a different rate. These rates increase as income rises. In the U.S., for example, the federal government employs a progressive tax system with multiple brackets. As of 2024, the U.S. has seven federal income tax brackets: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. However, it's important to note that only the income that falls within a specific bracket is taxed at that rate, not your entire income. Here’s a simplified breakdown of how tax brackets work:- 10% bracket: This is the lowest bracket and applies to income up to a certain threshold. For example, a single filer might pay 10% on the first $11,000 of income.

- 12% bracket: Income beyond the 10% threshold but up to the next limit (say, $44,725 for a single filer) is taxed at 12%.

- 22% bracket: The next chunk of income beyond the 12% bracket is taxed at 22%, and so on, moving up the scale.

Example of How It Works

Let’s say you're a single filer and you earn $50,000 in taxable income in 2024. The tax calculation would look something like this:- The first $11,000 is taxed at 10%, resulting in $1,100 in taxes.

- The income between $11,001 and $44,725 (which is $33,725) is taxed at 12%, resulting in $4,047 in taxes.

- The remaining income from $44,726 to $50,000 (which is $5,275) is taxed at 22%, resulting in $1,160.50 in taxes.

Key Points About Tax Brackets

- Marginal vs. Effective Tax Rate: Your marginal tax rate is the rate applied to your highest dollar of income. In the previous example, that would be 22%. Your effective tax rate, however, is the average rate you pay on all your income. This is generally lower than your marginal rate since not all income is taxed at the highest bracket.

- Filing Status and Brackets: Tax brackets depend on your filing status, such as single, married filing jointly, married filing separately, or head of household. Different filing statuses have different income thresholds for each bracket.

- Bracket Adjustments: Tax brackets are often adjusted annually for inflation. This means that the income thresholds for each bracket may increase slightly each year to keep pace with rising prices.

- State and Local Taxes: In addition to federal tax brackets, many states have their own tax brackets or flat tax rates. Some states have a progressive system like the federal government, while others may tax everyone at the same rate regardless of income.

Understanding Your Own Taxes

To calculate your taxes accurately, you’ll need to know more than just the federal tax brackets. Other factors come into play, such as:- Deductions: These reduce your taxable income. Standard deductions are available based on your filing status, or you can itemize deductions to reduce your taxable income further.

- Credits: These directly reduce the amount of tax you owe, unlike deductions, which reduce taxable income. Common credits include the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC).

Why Do Tax Brackets Matter?

Understanding tax brackets helps you manage your financial planning, especially if you're considering a raise or other forms of additional income. Knowing which tax bracket your next dollar of income falls into can help you make better decisions about retirement contributions, deductions, and other tax strategies. It can also help you estimate your tax liability for the year, which is crucial for budgeting and avoiding underpayment penalties.Conclusion

Tax brackets are a fundamental part of the tax system in progressive tax jurisdictions like the U.S. They ensure that higher-income individuals pay a larger percentage of their income in taxes than those with lower incomes, while still allowing every taxpayer to benefit from lower rates on the first portions of their income. Understanding how tax brackets work and where you fall within them can help you make informed decisions about your finances and tax planning.Read more :

1= https://bulkdrchecker.com/blogs/what-are-the-temperatures-on-mars/

2= https://bulkdrchecker.com/blogs/what-are-the-tax-brackets/

3= https://bulkdrchecker.com/blogs/what-are-the-tallest-buildings-in-the-world/

4= https://bulkdrchecker.com/blogs/what-are-the-symptoms-of-the-flu/

5= https://bulkdrchecker.com/blogs/what-are-the-symptoms-of-multiple-sclerosis-ms/